There is no particular period after which a business needs to raise fund. The founders need to set foot on the ground, make sense of their plans and its practicality, and invest some energy in the market, contemplating patterns and profiles. Entrepreneurs ought to have a reasonable photo of the position of their item and recognized their arrangement of clients.

What is most imperative to raise funds is to have the capacity to influence the investors and persuade them about the product-market fit and show genuine development and traction. You naturally need a firm startup business model first that is a winner, need at least a product prototype before you need to raise funding from professional angel investors or VCs.

In this post, we'll cover:

Financing Structures

A startup can bring investment up in two structures – obligation or value.

Obligation Financing

This sort of financing secures the investor. It resembles a credit offered to the business with a primary sum, loan fee, and a development date at which important and intrigue must be reimbursed. The expectation of this sort of subsidizing is that it changes over into value when the startup does value financing.

Value Financing

This sort of financing incorporates assessing the startup, settling an offer cost, and pitching these offers to speculators. This sort of financing includes more lawful complexities and is hence not exceptionally prominent in the underlying rounds of subsidizing.

Key Factors that affect how much money you should raise

Securing the right amount of funding is a critical decision for startup founders. Raising too little capital can hinder growth, while raising too much can lead to unnecessary dilution or misallocation of resources. In this article, we’ll explore key factors and considerations to help you determine how much money you should raise for your startup.

Assess Your Financial Needs

Start by assessing your startup’s financial requirements. Consider various aspects such as product development, marketing, operational costs, staffing, and contingency funds. A thorough understanding of your financial needs will enable you to estimate the initial funding required to support your growth plans.

Create a Detailed Financial Plan

Develop a comprehensive financial plan that includes revenue projections, expense forecasts, and cash flow analysis. This plan will help you determine the amount of funding required to sustain your operations until you achieve profitability or reach the next funding milestone.

Consider Your Growth Strategy

Your growth strategy plays a crucial role in determining the funding amount. Evaluate your business model, target market, and growth potential. Determine the pace at which you aim to scale and expand. A more aggressive growth strategy may require a higher funding amount to fuel marketing campaigns, product development, and market penetration efforts.

Factor in a Buffer

It’s prudent to incorporate a buffer when estimating the funding amount. Unexpected expenses or delays can arise during the startup journey. Including a safety net in your funding calculations ensures you have adequate resources to navigate unforeseen challenges without disrupting operations or requiring additional funding rounds.

Seek Professional Advice

Consulting with industry experts, mentors, and advisors can provide valuable insights and guidance. They can offer advice on market norms, industry benchmarks, and funding trends specific to your sector. Their experience and knowledge can help you refine your funding strategy and determine an appropriate funding amount.

Evaluate Your Funding Sources

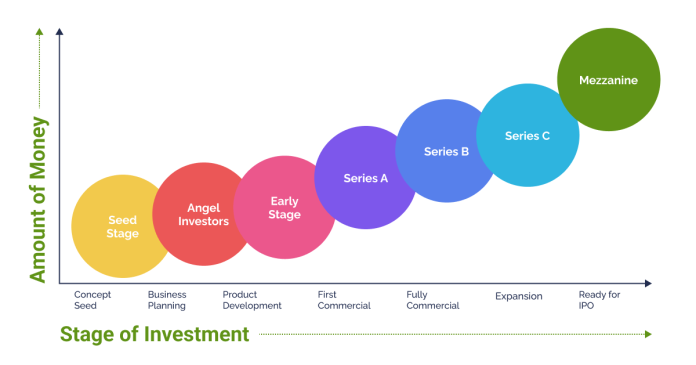

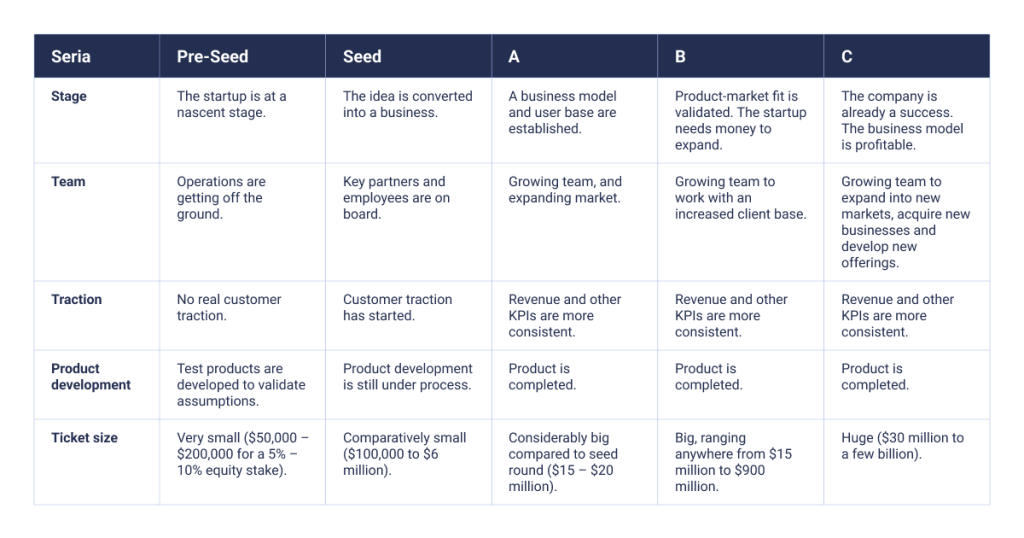

Different funding sources have varying capacities and expectations. Research and understand the funding landscape, including options such as bootstrapping, angel investors, venture capital firms, government grants, and crowdfunding, depending upon your startup stage. Each source has its own limitations, requirements, and potential funding amounts. Consider the pros and cons of each option in alignment with your business objectives.

So, on top of how much money should you raise, you also have to consider the range of typical funding amount different type of investors are comfortable with.

Angel Investors – Angel investors give subsidizing at beginning phases of business, mostly in the form of pre-seed or seed funding. They would for the most part not get exceptionally specialized, and put resources into the business on the off chance that they have a decent hunch about it.

Venture Capital (VC) Firms – The VCs come in when the business develops past the validation stage and starts generating revenues. VC funding is provided for the primary purpose of growth. These type of investors subsidize in colossal sums if persuaded by plans of action, valuations and development patterns.

Crowdfunding – This kind of funding is picking up prominence wherein the site enables organizations to pool little speculations from various speculators as opposed to constraining organizations to search for a solitary venture.

SME loaning – Businesses can settle on unsecured or secured working capital advance offered by various small scale financing firms in showcase today. Be that as it may, this alternative accompanies a settled month to month commitment and moderately higher financing costs.

Stipends – Businesses in specific lines of operation, for example, innovative work should approach and enquire for government allows or helps. Different plans are controlled by the administration to advance these businesses.

Conclusion

Determining the right funding amount for your startup is a balancing act that requires careful consideration. By assessing your financial needs, creating a detailed financial plan, aligning with your growth strategy, evaluating funding sources, factoring in a buffer, and seeking professional advice, you can make informed decisions about how much money to raise. Remember, a well-calibrated funding strategy sets the stage for sustainable growth and positions your startup for long-term success.